Your Reliable High Quality Wholesale Custom Clothing Manufacturers

Trump’s 2025 Tariff Tsunami: How the Commodity Price Impact on the Apparel Industry

American households will soon lose $3,800 in purchasing power because of rising commodity prices from Trump’s new tariff policies. This is a significant impact tied to the increase in commodity price.

The apparel industry faces even greater challenges. U.S. retailers import more than 98% of their clothing, and current commodity prices will drive clothing costs up by 10% to 20%. Market conditions become more complex with international commodity prices. Vietnam now faces a 46% tariff rate. Cambodia deals with 49%, and Bangladesh confronts 37%.

These price increases signal a lasting shift rather than temporary changes in commodity futures prices. U.S. manufacturers produce only 3% of apparel, which creates significant challenges for cost management across the industry.

This piece examines how apparel businesses can guide through these challenging times. We’ll take a closer look at survival tactics and adaptation strategies to help your business keep up with trends.

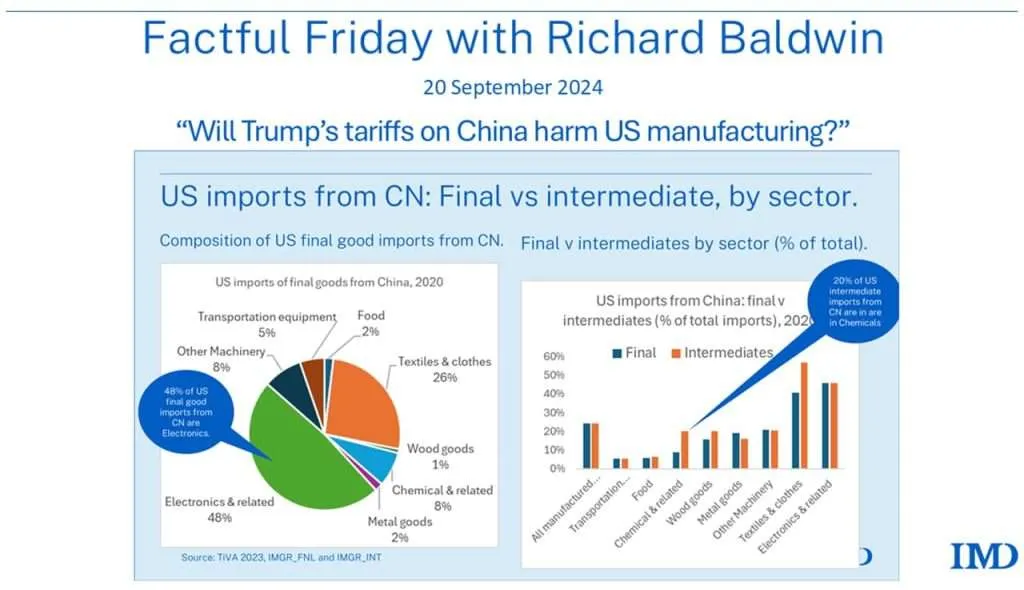

Understanding Trump’s 2025 Tariff Structure

Trump’s far-reaching tariff structure stands as the biggest change in trade policy in almost 100 years. His plan targets the world’s biggest apparel manufacturing countries and will change international commodity prices throughout the supply chain.

Key countries and their new tariff rates

Trump’s tariff plan sets a 10% duty baseline on all imports, with much higher rates for major apparel producing nations:

- China faces a 34% additional tariff on top of existing 20% duties, totaling 54%

- Vietnam, America’s second-largest apparel source, will see a 46% tariff

- Cambodia has been assigned a punishing 49% rate

- Bangladesh faces a 37% tariff

- Indonesia will see duties of 32%

- European Union goods will be subject to 20% tariffs

These new duties will push the average U.S. import tariff rate on apparel from 14.5% in 2024 to 30.6%. This change will result in about $26 billion in duties on apparel – more than double last year’s level.

Timeline for implementation

The plan rolls out in stages:

- The universal 10% baseline tariff takes effect April 5, 2025, at 12:01 a.m. EDT

- Country-specific “reciprocal” tariffs begin April 9, 2025, at 12:01 a.m. EDT

- The de minimis exemption for goods from China and Hong Kong ends on May 2, 2025

Goods valued under $800 that were duty-free before will now face either 30% of their value or $25 per item. This rate jumps to $50 per item after June 1.

Comparison with previous trade policies

Trump’s second-term tariff approach makes his previous trade actions look small. His first administration’s tariffs affected about $380 billion worth of goods. The current policies now touch over $2.5 trillion in U.S. imports.

On top of that, Trump has used the International Emergency Economic Powers Act (IEEPA) to declare a national emergency over the $1.2 trillion U.S. global goods trade deficit from 2024. This authority had only been used for economic sanctions before, never for tariffs.

The new structure aims to change current commodity prices in every sector. Apparel businesses see these tariffs as “purpose-built to hobble the industry.” The impact runs deep since these countries make up 85% of apparel imports.

Immediate Impact on Apparel Supply Chains

The apparel industry faces a massive shock throughout its global supply networks. Trump’s tariffs send ripples through the entire value chain. Companies that spent years trying to broaden their operations beyond China now find themselves caught in a perfect storm of new trade barriers.

Disruption to existing sourcing networks

Major U.S. brands have poured billions into changing production away from China. Their alternative manufacturing hubs now face crushing tariffs. Nike makes half its footwear and about 30% of its apparel in Vietnam. Adidas depends on this Asian nation for 39% of its footwear and 18% of its apparel. These carefully planned changes now seem pointless as Vietnam faces a 46% tariff rate.

Factory usage in major production regions has dropped sharply. The numbers fell from 100% in 2021 to 60-70% in 2023. The redistribution of sourcing has been slower than predicted because of capacity limits, which makes the current disruption worse.

Current commodity prices across manufacturing hubs

Raw material prices have dropped 30-50% for items like cotton and oil in recent years. Yet these savings haven’t reached consumers or manufacturers. Recent data shows the Producer Price Index for apparel manufacturing reached 136.732 in February 2025.

Raw cotton makes up 50-60% of total yarn costs for a typical mid-priced knit garment. The 30% drop in raw cotton prices should have led to 5-7% lower apparel costs. In spite of that, few companies have seen real savings from suppliers during this tariff chaos.

Cash flow challenges for manufacturers and retailers

Retailers struggle with severe cash flow problems as they face immediate cost increases. The new tariffs would push duties on apparel past $26 billion, based on 2024 import values. Retailers might have to raise prices by 10-12% just to handle the effect of Vietnam tariffs alone.

This creates a three-way squeeze:

- Factories running on slim margins face pressure to cut prices

- Brands must decide between absorbing costs or passing them to consumers

- Inventory management becomes crucial as lead times grow and orders change

Someone will have to pay the price—and it might be everyone in the supply chain.

Short-Term Survival Strategies

Apparel companies face a new challenge as tariffs set to double to $26 billion across the industry. Companies must quickly develop survival tactics. “Everyone is scrambling to check their assumptions related to price,” noted one industry executive. Let’s look at how brands tackle this tariff tsunami right now.

Inventory management tactics

Many companies now use forward buying as their go-to strategy by stockpiling inventory before tariffs kick in. The strategy has its limits though. Most businesses can only buy forward for five to six months before they hit working capital constraints. Some companies have built dedicated “tariff task forces” that bring together team members from sourcing, production, and merchandising to handle inventory challenges.

Businesses need a careful approach to frontloading inventory for current commodity prices:

- Stock up on high-demand items instead of slow-moving or seasonal products that might cost more to store than save on tariffs

- Ship products in bulk to finish packaging or assembly in the US to cut down tariff exposure

- Use AI-powered supply chain tools to forecast demand more accurately and avoid overstocking

Price adjustment considerations

Fashion retailers plan to raise prices by about 15% [link_2] to deal with the tariffs. The market looks tough all the same. Consumer research shows that with 10-20% price increases, 58% of shoppers would look for cheaper options. Only 14% would buy at higher prices.

Some brands look beyond simple price hikes. They use rebates to recover margins while keeping prices competitive. Other companies think about being upfront about tariff effects by showing them as separate items next to product prices.

Negotiating with suppliers and partners

Overseas manufacturers run on razor-thin margins, which makes negotiations tricky. Big retailers like Walmart and Target push suppliers to absorb some tariff costs. Smaller companies can strike bulk contracts with “a negotiated price, delivered into the U.S., including tax and duties”.

Companies should add tariff clauses or cost-sharing agreements for longer contracts. Some businesses hold back shipments ready for import while they wait for possible rate negotiations. This shows how timing and flexibility serve as key bargaining tools in today’s uncertain commodity prices market.

Long-Term Adaptation for Apparel Businesses

Apparel businesses need structural changes to thrive in a world of perpetually higher tariffs. Their survival depends on adapting to international commodity price fluctuations.

Diversifying production locations

Apparel companies are moving their global sourcing away from traditional manufacturing centers. Asia still holds seven of the top ten most used apparel sourcing destinations. The landscape shows dramatic changes as India leads the pack. Nearly 60% of fashion companies plan to expand their sourcing operations in India through 2026. Bangladesh and Vietnam remain attractive options despite some compliance issues.

Companies have moved just 20% of their production to North America, though they aim for 50%. This careful approach makes sense because completely abandoning established manufacturing networks costs too much.

Investing in automation and efficiency

Higher prices have made automation essential to stay competitive. 80% of factories in Bangladesh will buy automated machines in the next two years. Each machine could replace one to six workers. All the same, these investments boost product quality and worker efficiency.

Progressive manufacturers Mohammadi Group and Envoy Textiles now use automated knitting machines and robotic autoconers. Beximco Group runs AI-powered software that optimizes fabric use and cuts material waste. These solutions help manage commodity futures price swings.

Exploring nearshoring opportunities

Nearshoring marks a fundamental change in how apparel gets made. US fashion companies sourcing from USMCA members jumped to 65% in 2023, up from 40% in 2020. Turkey’s share in global textile production has doubled in the last two decades.

Rising tariffs strengthen the case for nearshoring. The benefits include lead times that are 3-5x faster. Companies also get better flexibility and much smaller carbon footprints.

Developing direct-to-consumer channels

Direct-to-consumer (DTC) channels give apparel businesses better control over pricing and customer relationships. Online purchases through DTC brands should reach almost 40% in the U.S. within five years. The DTC market value could hit USD 1.00 trillion.

This model lets businesses control product pricing better during commodity price swings. Gen Zers (36%) and millennials (27%) don’t mind paying 6-8% extra for socially-compliant products. This premium pricing helps offset how tariffs affect commodity prices today.

Conclusion

Trump’s tariff policies are transforming global trade, and apparel businesses must adapt quickly. These policies could double duties to $26 billion and increase clothing costs by 20%. However, companies can implement smart strategies to navigate these challenges effectively.

The path to success requires a multi-faceted approach. Companies should manage their inventory wisely and build stronger relationships with suppliers. They can also gradually move their production to different locations. While moving all manufacturing back home isn’t feasible, businesses that embrace automation and strengthen their direct-to-consumer channels have better survival odds.

The current trade policy transformation requires swift action today and careful planning for tomorrow. Successful companies will balance cost-cutting measures with strategic investments in diverse operations and optimization. Those who respond with agility and insight will emerge more robust in this evolving market landscape.

FAQs

Q1. How will Trump’s 2025 tariff plan affect clothing prices for consumers?

Consumers can expect clothing prices to increase by 10% to 20% due to the new tariffs. This is because the U.S. imports over 98% of its clothing, and the tariffs will significantly impact the cost of imported apparel.

Q2. Which countries are most affected by the new tariff structure?

The countries most affected include China (54% total tariff), Vietnam (46% tariff), Cambodia (49% tariff), and Bangladesh (37% tariff). These nations are major apparel manufacturing hubs for the U.S. market.

Q3. What strategies can apparel businesses use to mitigate the impact of tariffs?

Businesses can employ strategies such as forward buying inventory, negotiating with suppliers, exploring nearshoring opportunities, investing in automation, and developing direct-to-consumer channels to help offset the impact of tariffs.

Q4. How are retailers planning to adjust their pricing in response to the tariffs?

Many fashion retailers are considering raising prices by approximately 15% on average. However, some are exploring alternative strategies like using rebates to recover margins while maintaining competitive pricing or transparently communicating tariff impacts to consumers.

Q5. What long-term changes are apparel companies making to adapt to the new trade environment?

Companies are diversifying production locations, with India emerging as a popular alternative. They’re also investing in automation and efficiency improvements, exploring nearshoring opportunities in countries like Mexico and Turkey, and developing direct-to-consumer channels for greater control over pricing and customer relationships.